georgia estate tax laws

No there is no Georgia estate tax. The bill has two main thrusts.

Georgia Retirement Tax Friendliness Smartasset

Property in Georgia is assessed at 40 of the fair market value unless otherwise specified by law.

. The estate tax is different from the inheritance tax. Due to the high limit many estates are exempt from estate taxes. Select Popular Legal Forms Packages of Any Category.

No Georgia does not have an estate tax or an inheritance tax on its inheritance laws. Georgians are only accountable for federally-mandated estate taxes. Real Estate Family Law Estate Planning Business Forms and Power of Attrorney Forms.

Property and real estate laws affect renters and landlords as well as home owners or prospective home owners. A QA guide to Georgia laws on estate taxation of transfers at death. It all ensured that no estate tax returns were required.

Property Taxpayers Bill of Rights. Get your free copy of The 15-Minute Financial Plan from Fisher Investments. Georgia eliminated the requirement to file estate tax returns back on July 1 2014 when it changed its existing laws and declared that it would no longer assess any estate tax.

And while no one enjoys paying taxes they help fund important public services such as roads public schools fire departments and other. It is sometimes called the death tax The estate tax is applied before the people inheriting the money receive it. This QA addresses whether a jurisdiction has any estate tax or other similar taxes imposed at.

Dont leave your 500K legacy to the government. Dont leave your 500K legacy to the government. Any deaths after July 1 2014 fall under these rules.

Taxes are unavoidable in any state. Georgia Code 53-6-60 says that executors may be paid as stated in the will. Senate Bill 177 Act 431 was signed April 30 1999 and became effective January 1 2000.

If a person that owned a home with a fair market value of 100000 in an unincorporated area of a county where the millage rate was 2500 mills that persons property tax would be 95000--. The Department issues individual and generalized guidance to assist taxpayers in complying with Georgias tax laws motor vehicle tag and title laws and regulatory and licensing requirements. Nevertheless you may have.

Wills Trusts and Administration of Estates. Prevention of indirect tax increases. As of July 1 2014 Georgia does not have an estate tax either.

If no amount was included in the will it would be 2-12 percent on all money received into the estate and 2-12. All Major Categories Covered. Most states including Georgia have homestead protection laws allowing.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Ad Get free estate planning strategies. Before assuming that an estate is exempt it is critically important to analyze the estate.

In 2014 OCGA 48-12-1 went into effect eliminating estate taxes at the state level. Georgia has no inheritance tax. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Property Tax Homestead Exemptions. Georgia Code Title 53. Granted the old Georgia tax on estates did not represent an added cost above that imposed by the federal estate tax since Georgia used the so-called pick up tax until 2005.

July 07 2021. Any deaths after July 1 2014 fall. The assessed value--40 percent of the fair market value--of a house that is worth.

Ad Get free estate planning strategies. Wills Trusts and Administration of Estates. County Property Tax Facts.

By Busch Reed Jones Leeper PC. Property Tax Returns and Payment. Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax.

Get your free copy of The 15-Minute Financial Plan from Fisher Investments. Current as of April 14 2021 Updated by FindLaw Staff. Georgia law is similar to federal law.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

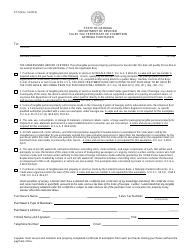

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Create A Living Trust In Georgia Legalzoom Com

Georgia Retirement Tax Friendliness Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Georgia Property Tax Calculator Smartasset

Exemption Summary Richmond County Tax Commissioners Ga

Georgia Property Tax Calculator Smartasset

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

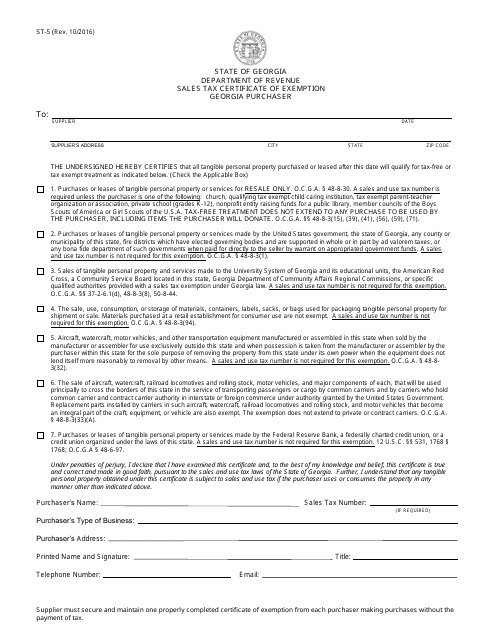

Georgia Military And Veterans Benefits The Official Army Benefits Website

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

Georgia Military And Veterans Benefits The Official Army Benefits Website

Exemption Summary Richmond County Tax Commissioners Ga

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor